This visual helps illustrate the nuances of each type of bagging in specialty pharmacy and what it may mean for your health system.

Expert insights on the rapid growth of specialty pharmacy and the importance of strategic integration.

By

Date

May 01, 2025

Read Time

4 minutes

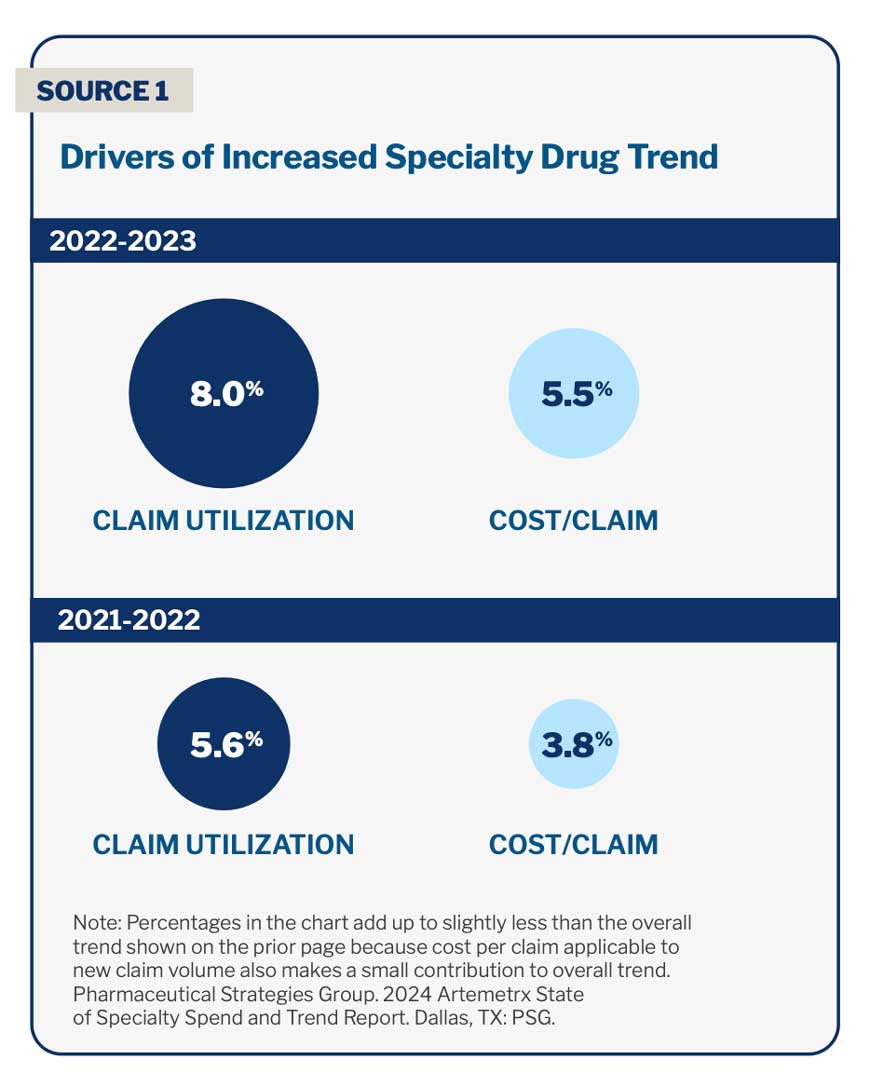

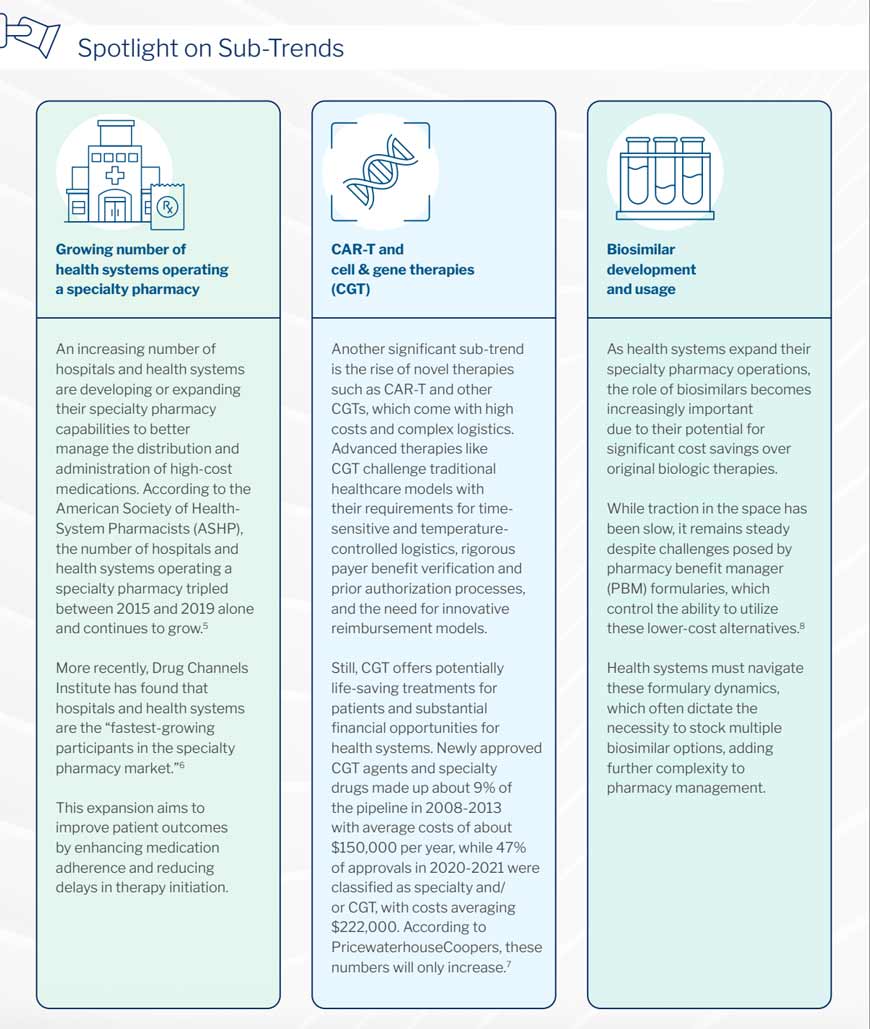

Virtually every aspect of the specialty pharmacy market continues to experience exponential growth, including drug spend (driven in part by an increase in both the number of specialty claims and the cost per claim), the disproportionate share of specialty drugs in the R&D and FDA-approval pipelines, and the swelling number of hospitals and health systems operating accredited specialty pharmacies. Between 2022 and 2023, the responsibility of the cost per specialty claim alone in driving the overall spend trend increased from 3.8% to 5.5%.1,2

At the same time, health systems are challenged with increased leakage of: specialty dispensing, patient volumes, and even employee prescription capture due to various factors, such as site-of-care restrictions, payer-dictated formularies, and others.3,4 Having a robust, fully integrated specialty pharmacy is essential for improving patient care and ensuring seamless access to these medications while also supporting the financial health of the system.

Why It Matters to Health Systems

Integrating specialty pharmacies within health systems can significantly boost the system’s financial health and improve patient care. By managing these pharmacies in-house, systems capture more revenue from high-cost medications and help ensure better care coordination. This leads to improved treatment adherence and outcomes. This is particularly important as demand for specialized treatments grows, new therapies continue to hit the market, and payer- and PBM-mandated restrictions and limitations persist. Health systems with integrated specialty pharmacies will be well-equipped to meet these challenges, ensuring they provide high-quality patient care while maintaining fair competition in the healthcare market.

What to Watch For

Health systems should continue to monitor and assess opportunities for increasing prescription capture, boosting revenue and cost savings, and improving patient care through expanded specialty pharmacy strategies and new therapies—including novel cell and gene therapies and the increased usage of biosimilars.

For more information about how our P&AS experts can help you achieve more for the business of pharmacy, contact us directly at pas@mckesson.com or download the full Health System Pharmacy Market Outlook Report.

1. https://link.psgconsults.com/2024-spend-and-trend-report/

5. https://www.drugchannels.net/2024/04/the-top-15-specialty-pharmacies-of-2023.html

6. https://www.visanteinc.com/wp-content/uploads/2024/01/Visante-Top10FullArticle-Jan-2024.pdf

7. https://truveris.com/2024-pharmacy-outlook-top-5-pharmacy-benefits-trends/